What’s changing on 1 July?

What’s changing on 1 July? Company tax rate reduces to 26% for base rate entities Cents per km rate for work-related car expenses increase to 72 cents Expected reforms to allow 66 and 67 years olds to make voluntary superannuation contributions without satisfying the work test. This reform is not yet law. Age limit for […]

Have Casual Workers Been Granted Annual Leave?

News headlines recently stated that casual workers have won the right to paid leave following a decision in the Federal Court. As usual, the devil is in the detail. At present, there is no global change granting Australian casual workers paid leave. The case however, highlights the long running problem of determining over time, who […]

MGI Adelaide – Open For Business

DUE TO COVID-19 AND SOCIAL DISTANCING CONSIDERATIONS, MGI ADELAIDE’S PHYSICAL OFFICE IS CLOSED – BUT WE ARE ABSOLUTELY OPEN FOR BUSINESS! Due to the situation created by COVID-19 and following guidance from the Australian Government and our own sense of social responsibility. MGI Adelaide’s physical office has been closed since Monday 6th April 2020 until further notice […]

Second Stimulus Package

Supporting Australian workers and business In a continued effort to support Australian businesses through the impact of the COVID19 pandemic the government has further stimulus measures today aimed at keeping the Australian economy going as smoothly as possible during these extremely challenging times. The enhanced stimulus package includes both increases in originally announced measures as […]

The Stimulus Package: What You Need To Know

Eligibility For The Scheme The Government has announced a $17.6 billion investment package to support the economy as we brace for the impact of the coronavirus. The yet to be legislated four part package focuses on business investment, sustaining employers and driving cash into the economy. For business 1. Business investment Increase and extension of […]

Large Proprietary Company Thresholds to Double

Written by Jayson Palomaria: The financial reporting requirement for large proprietary companies to lodge their annual audited financial reports was introduced back in 1995 aimed at regulating the reporting of financial activities of proprietary companies which have a significant economic influence. The proprietary company reporting threshold contained in section 45A of the Corporations Act 2001, […]

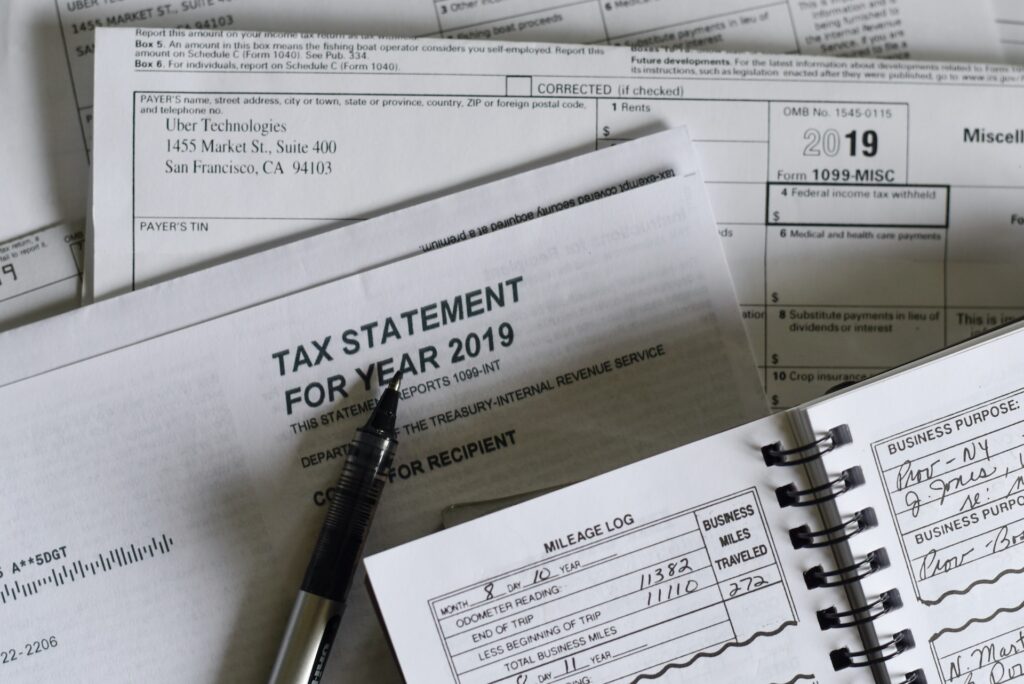

2019 Year End Tips

The 2019 financial year is quickly drawing to a close and we believe it is important that all our clients are informed of changes to the tax system and strategies to potentially reduce costs and taxes. The purpose of this is to make you aware of these important changes however the articles are for general advice and […]

Tax Implications when you dispose of Cryptocurrencies

Written by Emily Baulderstone: Have you been taking part in the cryptocurrency market in recent years? If so, are you aware of the tax consequences of these transactions and what records you need to keep? The ATO have recently announced that they will be collecting data from cryptocurrency digital exchanges and data matching this with […]

Tax Planning 2019

30th June 2019 is rapidly approaching, so now is the time for business owners to talk to their Accountants to look at tax planning. Tax planning enables taxpayers to consider a range of strategies which could help to effectively manage and plan for their taxation liabilities. There are some common and simple strategies that […]

2019 Federal Budget Breakdown

On the 2 April 2019, Treasurer Josh Frydenberg handed down his maiden budget. In what was clearly an election year budget, the Treasurer announced significant personal tax cuts to be delivered over the next five years, while simultaneously announcing a forecast budget surplus of $7.1 billion for 2019-20, and a big focus on healthcare, education […]