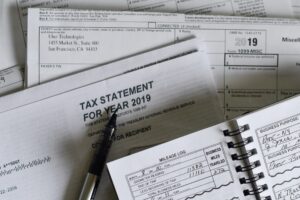

ATO Interest No Longer Tax Deductible – We have a solution!

Important Tax Update: ATO Interest Deductions Ending Soon From 1 July 2025, interest charged by the ATO on unpaid tax debts will no longer be

Important Tax Update: ATO Interest Deductions Ending Soon From 1 July 2025, interest charged by the ATO on unpaid tax debts will no longer be

With 30 June fast approaching, we thought it would be an opportune time to provide you with a Year-End Planning memorandum. This document details key

It’s FBT Time – What You Need to Know for 2025! The Fringe Benefits Tax (FBT) year ended on 31 March 2025, and it’s now

Click here for our full recap of the budget. On Tuesday, 25 March 2025, Treasurer Jim Chalmers handed down the 2025-26 Federal Budget. The Budget’s

We want to inform you about an important update from the Australian Taxation Office (ATO) regarding their approach to collecting unpaid tax and superannuation debts.

Access the full guide here. With 30 June fast approaching, we thought it would be an opportune time to provide you with a Year-End Planning

Read our recap of the budget in full detail here. Last night, Treasurer Jim Chalmers handed down the 2024 – 2025 Budget in Parliament House.

With 30 June fast approaching, we thought it would be an opportune time to provide you with a Year End Planning memorandum detailing key dates, recent reforms and tax planning opportunities for you and your business.

MGI Adelaide is pleased to present our summary of the recently released federal budget and its implications for our clients.

This first budget of the new Labor Government delivers a reallocation of resources and a shifting of focus by the government rather than any significant new measures. This budget is aimed at buffering the impact of global uncertainty being agitated by war, floods and the pandemic. Read our full budget analysis.

MGI Adelaide is hosting a live event on Wednesday 17 August 2022 for our SMSF and wholesale clients. Join us to hear from our superannuation services manager Michael Wang and our client, CrowdProperty Australia.

With 30 June fast approaching, we thought it would be an opportune time to provide you with a Year – End Planning memorandum detailing key dates, recent reforms and tax planning opportunities for you and your business.

In 2019 MGI Adelaide Director, Angela Robins and other members of the firm identified a need to build a community around supporting each other and the strong female leaders in their network and client base. From that idea Success Her Way was born.

As of 1 November 2021, local and foreign directors of Australian companies can apply for a director ID. All eligible directors will be issued with

We recently supported our client CrowdProperty Australia with the launch of their company and product to the Australian market. CrowdProperty is an online marketplace platform

Last night, our Treasurer Josh Frydenberg delivered the 2021-22 Federal Budget to Parliament. He emphasised that our economy has recovered strongly post COVID and is

Between April to May 2020, JobKeeper was taken up by 920,000 organisations and around 3.5 million individuals – 30% of pre-Coronavirus private sector employment. On

What’s changing on 1 July? Company tax rate reduces to 26% for base rate entities Cents per km rate for work-related car expenses increase to

News headlines recently stated that casual workers have won the right to paid leave following a decision in the Federal Court. As usual, the devil

The Government has announced grants of $25,000 to encourage people to build a new home or substantially renovate their existing home. The HomeBuilder scheme targets

DUE TO COVID-19 AND SOCIAL DISTANCING CONSIDERATIONS, MGI ADELAIDE’S PHYSICAL OFFICE IS CLOSED – BUT WE ARE ABSOLUTELY OPEN FOR BUSINESS! Due to the situation created by

Supporting Australian workers and business In a continued effort to support Australian businesses through the impact of the COVID19 pandemic the government has further stimulus

To Our Valued Clients, During this incredibly challenging time, we want to assure you that we are taking steps to safeguard this firm, so we

Eligibility For The Scheme The Government has announced a $17.6 billion investment package to support the economy as we brace for the impact of the

Written By Jacob Henson: The 2019/2020 South Australian Budget has been announced and Treasurer Rob Lucas has proposed several changes to the Land Tax legislation.

Written by Jayson Palomaria: The financial reporting requirement for large proprietary companies to lodge their annual audited financial reports was introduced back in 1995 aimed

The 2019 financial year is quickly drawing to a close and we believe it is important that all our clients are informed of changes to the

Written by Emily Baulderstone: Have you been taking part in the cryptocurrency market in recent years? If so, are you aware of the tax consequences

Let MGI shout you a coffee and chat about how we can help.

Sign up to get the latest advice on managing your business and personal finances.

MGI Worldwide is a leading international network of separate and independent accounting, legal and consulting firms that are licensed to use “MGI” or “member of MGI Worldwide” in connection with the provision of professional services to their clients. MGI Worldwide is the brand name referring to a group of members of MGI Ltd., a company limited by guarantee and registered in the Isle of Man with registration number 013238V, who choose to associate as a network as defined in IESBA and EU rules. MGI Worldwide itself is a non-practising entity and does not provide professional services to clients. Services are provided by the member firms of MGI Worldwide. MGI Worldwide and its member firms are not agents of, and do not obligate, one another and are not liable for one another’s acts or omissions.

212 Greenhill Road

Eastwood, SA 5063

Australia

PO Box 96

Fullarton, SA 5063

Australia