ATO Interest No Longer Tax Deductible – We have a solution!

Important Tax Update: ATO Interest Deductions Ending Soon From 1 July 2025, interest charged by the ATO on unpaid tax debts will no longer be tax deductible. This applies to general interest charges on income tax, GST, PAYG and superannuation liabilities. If you have a current payment plan with the ATO or anticipate needing one, […]

2025 Year-End Planning Guide

With 30 June fast approaching, we thought it would be an opportune time to provide you with a Year-End Planning memorandum. This document details key dates, recent reforms and tax planning opportunities that may affect you and your business. Read our year-end planning guide Key Summary Points Please do not hesitate to contact our office […]

Year End Planning Guide – June 2023

With 30 June fast approaching, we thought it would be an opportune time to provide you with a Year End Planning memorandum detailing key dates, recent reforms and tax planning opportunities for you and your business.

Extension of the JobKeeper Payment

Between April to May 2020, JobKeeper was taken up by 920,000 organisations and around 3.5 million individuals – 30% of pre-Coronavirus private sector employment. On 21 July 2020, the Government announced an extension of the JobKeeper program to 28 March 2021 but with tighter access and reduced rates. From 28 September 2020, employers seeking to […]

What’s changing on 1 July?

What’s changing on 1 July? Company tax rate reduces to 26% for base rate entities Cents per km rate for work-related car expenses increase to 72 cents Expected reforms to allow 66 and 67 years olds to make voluntary superannuation contributions without satisfying the work test. This reform is not yet law. Age limit for […]

Have Casual Workers Been Granted Annual Leave?

News headlines recently stated that casual workers have won the right to paid leave following a decision in the Federal Court. As usual, the devil is in the detail. At present, there is no global change granting Australian casual workers paid leave. The case however, highlights the long running problem of determining over time, who […]

HomeBuilder: What is it and how do you access it?

The Government has announced grants of $25,000 to encourage people to build a new home or substantially renovate their existing home. The HomeBuilder scheme targets the residential construction market by providing tax-free grants of $25,000 to eligible owner-occupiers, including first home buyers, to build a new home or substantially renovate their existing home. The grants […]

Second Stimulus Package

Supporting Australian workers and business In a continued effort to support Australian businesses through the impact of the COVID19 pandemic the government has further stimulus measures today aimed at keeping the Australian economy going as smoothly as possible during these extremely challenging times. The enhanced stimulus package includes both increases in originally announced measures as […]

Large Proprietary Company Thresholds to Double

Written by Jayson Palomaria: The financial reporting requirement for large proprietary companies to lodge their annual audited financial reports was introduced back in 1995 aimed at regulating the reporting of financial activities of proprietary companies which have a significant economic influence. The proprietary company reporting threshold contained in section 45A of the Corporations Act 2001, […]

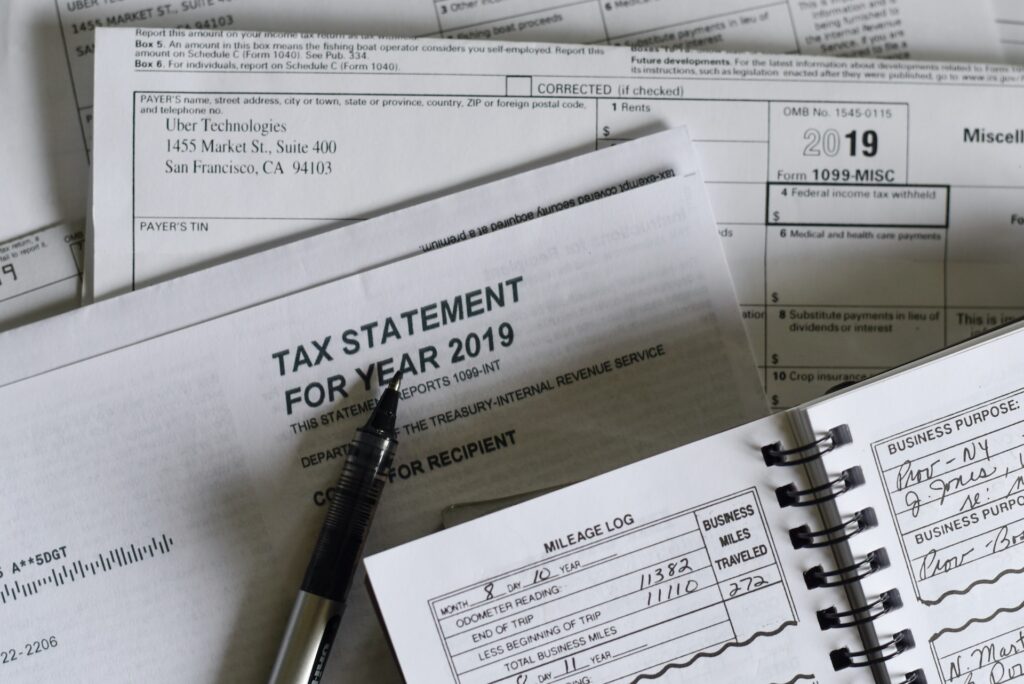

2019 Year End Tips

The 2019 financial year is quickly drawing to a close and we believe it is important that all our clients are informed of changes to the tax system and strategies to potentially reduce costs and taxes. The purpose of this is to make you aware of these important changes however the articles are for general advice and […]